Summer 2022 Survey

Welcome to the latest edition of the Allen Matkins/UCLA Anderson Forecast

The Impact of Near-Term Headwinds on Commercial Real Estate in California

Adjunct Professor of Economics, UCLA Anderson School

Senior Economist and Director, UCLA Anderson Forecast

The last three years have been challenging to say the least. But for those in the business of developing and managing industrial and multi-family spaces, in the main, it has been profitable. In the office and retail spaces, however, these past years have been challenging. For all four, the challenges keep mounting. The COVID-19 pandemic is not over as wave after wave wash through the state; the conflict in Europe continues; the drought in California is not over; and rising interest rates have created the specter of a possible near-term recession. With these uncertainties in mind, we consider the latest data from the Summer 2022 Allen Matkins/UCLA Anderson Forecast California Commercial Real Estate Survey to show much more optimism about the next three years than the barrage of negative news about the economy might suggest.

There is always the risk that unforeseen events will derail a forecast and that risk is likely greater today than in the recent past... Since our Winter 2021/2022 Survey release there have been several important events that ought to have impacted commercial real estate. First, China continued stringent zero-COVID policies resulting in lockdowns in Shanghai and elsewhere that further interrupted manufacturing and port activity. Second, the Russian invasion of Ukraine increased energy prices and the cost of building both contributed to inflation rates not seen since the 1970s. In response the Federal Reserve has now embarked on an aggressive path of monetary tightening. Our forecast from the last Survey was summarized by:

Pessimism prevalent since 2020 has turned to optimism, and based on our past experience with the Survey, this foretells the beginning of a new growth period, particularly in retail and office construction.

That brief euphoria across all California CRE markets has now been impacted by these recent events. The current Survey, taken in late May 2022, reveals that at least in office and retail markets, the timing of the turn in the market foretold was too soon, and the previously reported optimism in industrial and multi-family, while warranted, was a bit high.

Statistical forecast analysis has as its basis the proposition that past statistical relationships hold into the future. A knowledge of those correlations, current data and perhaps some assumptions about data not yet known, lead to the forecast. Though events over the past six months have altered our forecast, the initial response to the opening up and continued growth in the state’s economy in spite of the Delta and Omicron variants of COVID, are clearly present in the current Allen Matkins/UCLA Anderson Forecast California Commercial Real Estate Survey. The Survey has a rich set of questions such that, with past trends in the Survey’s indexes, we can now infer a more nuanced turn of commercial real estate from the trough of the recession.

The Allen Matkins/UCLA Anderson Forecast California CRE Survey compiles the views of commercial real estate developers, owners, and investors with respect to markets three years hence. The three-year time horizon was chosen to approximate the average time a new commercial project requires for completion (though projects with significant entitlement and/or environmental issues often take much longer). The panelists’ views on vacancy and rental rates are key ingredients to their own business plans for new projects, and as such, the Survey provides insights into new, not yet on the radar, building projects and is a leading indicator of future commercial construction. For example, if a developer were optimistic about economic conditions in Silicon Valley’s office market in 2025, then initial work for a new project with an expected ready-for-occupancy date of 2025 — a business plan, preliminary architecture, and a search for financial backing — would have to begin no later than the latter part of 2022. Although optimism does not always translate into new construction projects, this sentiment is usually a prerequisite for it.

Office Space Markets

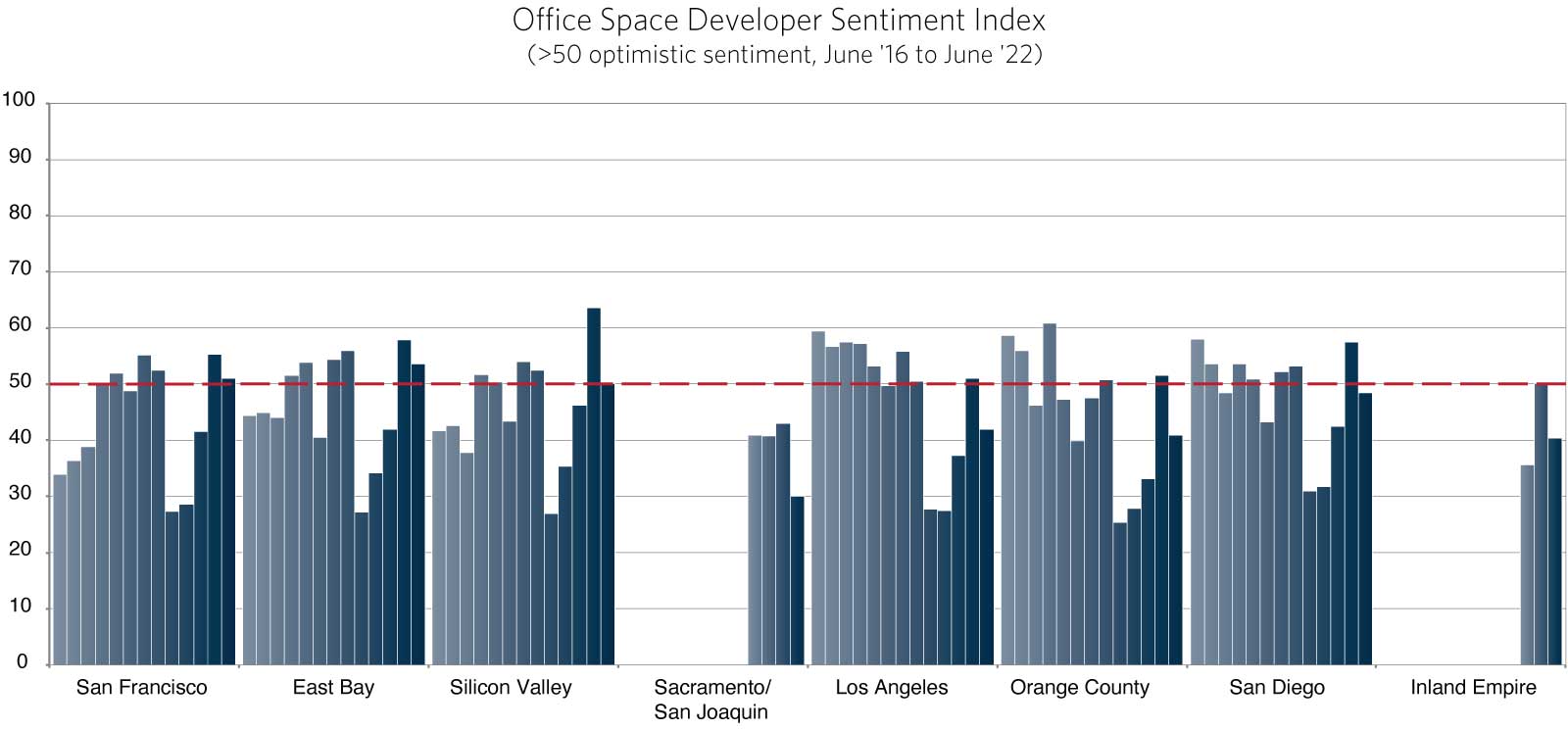

As we contrast the Winter 2021/2022 Survey with the Summer 2022 Survey we notice an abrupt change in sentiment. Optimism about the office market through 2024 has now turned to pessimism about the same market through 2025 in Southern California and a more neutral view in Northern California. What is clear is that the increased uncertainty about near term economic prospects has led to a more cautious view of investment in office space (Chart 1). Is this a temporary hiatus in activity for some? That is the open question raised by the Survey.

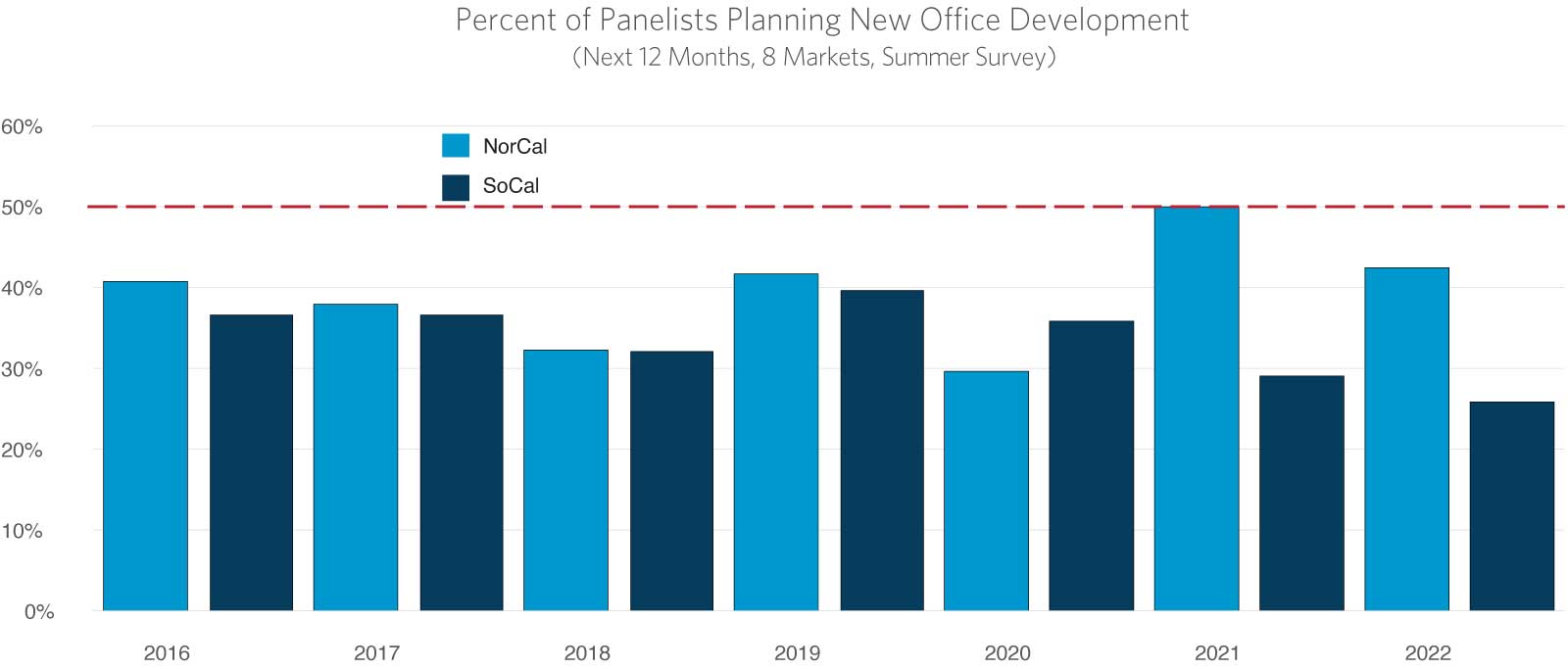

In Northern California, 3/4 of the panelists are now forecasting that by 2025 demand will have grown at least as fast as supply. The sole exception is the Sacramento market where there is a high dependence on the demand for space by state government. Even though the state general fund is in surplus, cost saving measures and tele-work by a significant number of state employees has resulted in more than 20 government office leases not being renewed. For the Bay Area, the panels are forecasting rental rates to remain soft, if not deteriorate, but occupancy rates to continue to improve. For the three Bay Area markets, the composite measure of sentiment has remained slightly optimistic though there are not yet plans in place to increase the rate of office development. The office market may not be back in Northern California just yet, but office development is projected to be increasing by the end of 2025 (Chart 2).

In Southern California, the panelists’ views are less pessimistic than in the previous Summer Survey but decidedly more so than in the Winter Survey six months ago (Chart 1). The aforementioned uncertainty has driven the sentiment index from positive to negative territory for each of the four markets surveyed. Across the board developers of office space are planning on staying on the sidelines for the next 12 months. Only 1/4 have plans to begin any new projects at this time. This metric of developer activity has not been this low since 2012. The signal six months ago that an imminent turn in this market has now dissolved into thin air. (Chart 2).

Though this turn of events has slowed the return to the office there are signs that it is temporary. Some large public companies are putting into place plans to return their workforce to the office. Increasingly companies are seeing the value of office-centric work for establishing culture, creating loyalty, inducing creativity and the mentoring of young employees. Likely, the tools learned during the strict work-from-home episode of 2020 will allow for more flexibility and less than full time in the office for many people. And the configuration of the office will surely be different post-pandemic. The implication of these factors is that there will ultimately be a need for new office development consisting of the remodeling of existing offices, the building of satellite offices to reduce employee commute times, and the creation of new mixed-use office complexes.

“The impact that we’ve seen from COVID over the last two and a half years on the markets has been extreme. But it’s been the acceleration of trends that were already happening in our marketplace.”

— Lewis C. Horne, President - Greater LA, OC & Inland Empire, CBRE

Industrial Space Markets

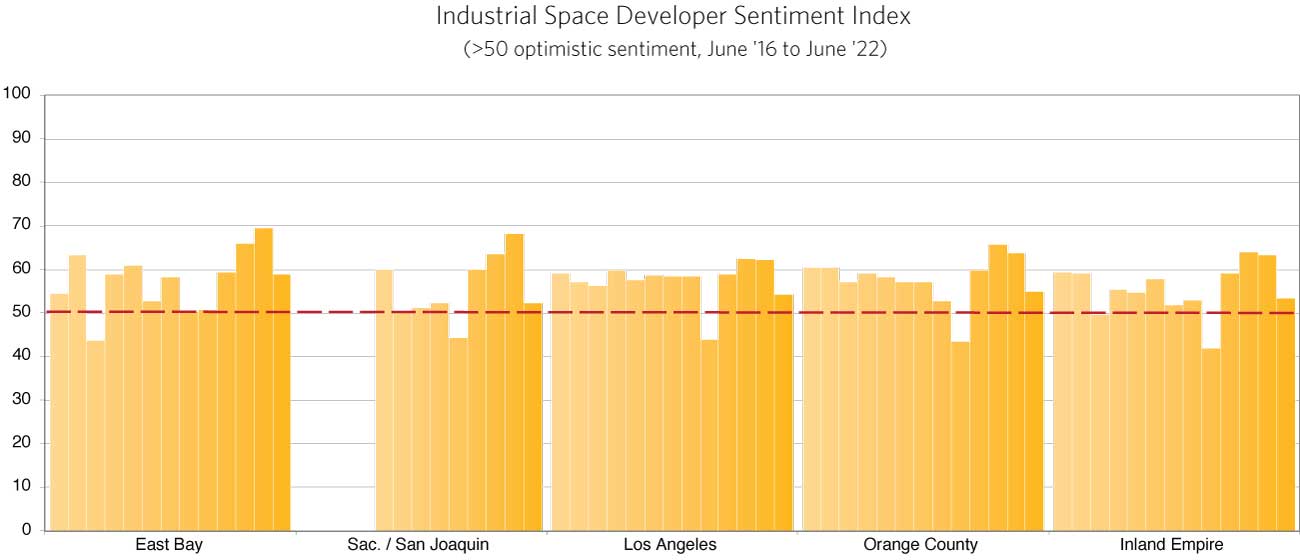

In the commercial real estate realm industrial space has been the star performer of late. Though development has continued at a torrid pace, it has barely kept up with absorption. For example, all of the new 1.5 million square feet of industrial space delivered to the market in Los Angeles in the first quarter of this year was reported to have been leased. Over the past several years there have been consistently high occupancy rates and superior lease rate growth. With the exception of the Summer 2020 Survey, industrial sentiment has remained well into the positive range (Chart 3). In the latest Survey, overall sentiment remains positive with respect to increased yields, and not surprisingly, neutral with respect to the already very low vacancy rates such as the below 2% rates in Los Angeles and the Inland Empire.

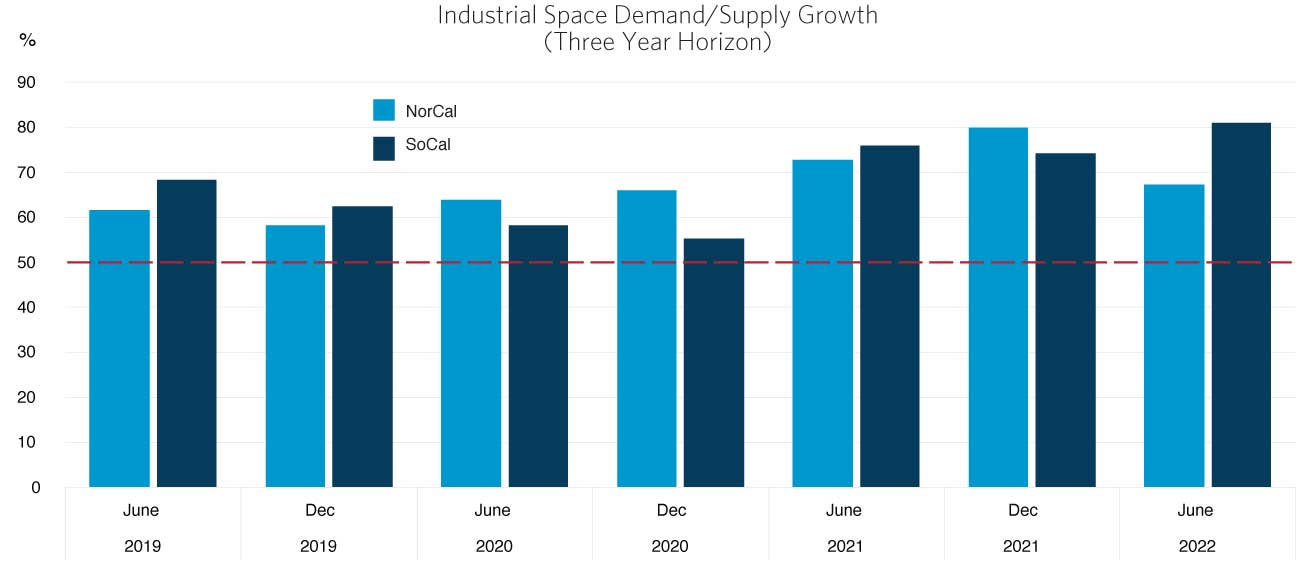

Chart 4 shows the demand and supply survey question responses for the past 3 1/2 years. A value over 50 indicates that the panels expect demand for space to increase faster than the supply of space during the three years following the survey date; a time frame that today spans the current recession worries. The continued positive outlook for industrial space rests on a forecast by our panelists for significant future increases in demand that will out strip planned and projected 2025 supply. This view of an even tighter market stems in part from the fact that demand in the last few years has driven vacancy rates to their astonishingly low levels.

Though optimism remains, industrial space developers are also approaching the next year with some caution. Among the current Survey panelists, 70% in Southern California and 43% in Northern California plan to begin at least one new development. The Southern California percentage planning new projects is the same as six months ago, but today fewer of these panelists will begin multiple projects. The Bay Area percentage for both single and multiple projects has declined by about 10 percentage points from six months ago.

“Industrial has been the hottest market. Vacancy is nearly almost at 1% or less and developers are finding new, creative ways to find land to build.”

— Chris Jackson, CEO, NAI Capital

Multi-Family Housing Markets

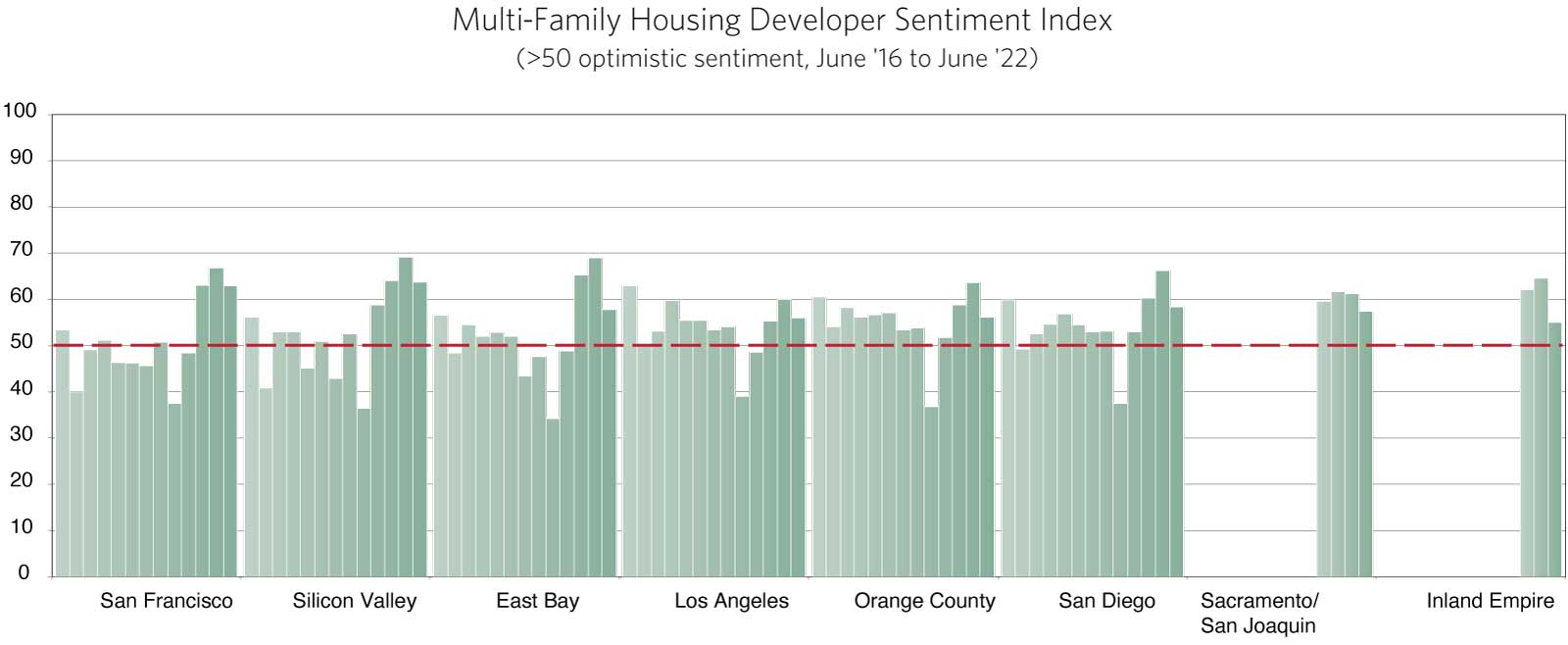

Despite the pandemic-induced demand for homes in the suburbs and a continued work-from-home culture, our multi-family panels remain bullish about the coming three years (Chart 5). In every market, including the pandemic work-from-home hit San Francisco market, there are forecasts for both rental rates increasing faster than the rate of inflation and vacancy rates falling between today and 2025. Although the continued arrival of waves of the pandemic delayed some return to the office, the reopening of city amenities and the creative and social value derived from urban experiences are attractors that are expected to induce increased density in multi-family living in the near future, particularly among younger workers.

Multi-family housing close to employment centers and transportation corridors is also attractive for many whose alternative would be long commutes from the outlying suburbs even if such a commute were to be only a few times per week. One would expect this to be augmented by a return to the city by those who have now been priced or interest-rated out of the purchase market.

Two other factors are important drivers of new multi-family development. First, the inland parts of the state are experiencing growth in logistics and infrastructure construction. Second, a series of state laws -- SB8, SB9 and SB10 -- superseded some local building approval processes, opened land currently zoned for single-family homes to the construction of small multi-family structures, and reduced barriers to multi-family construction in transit corridors.

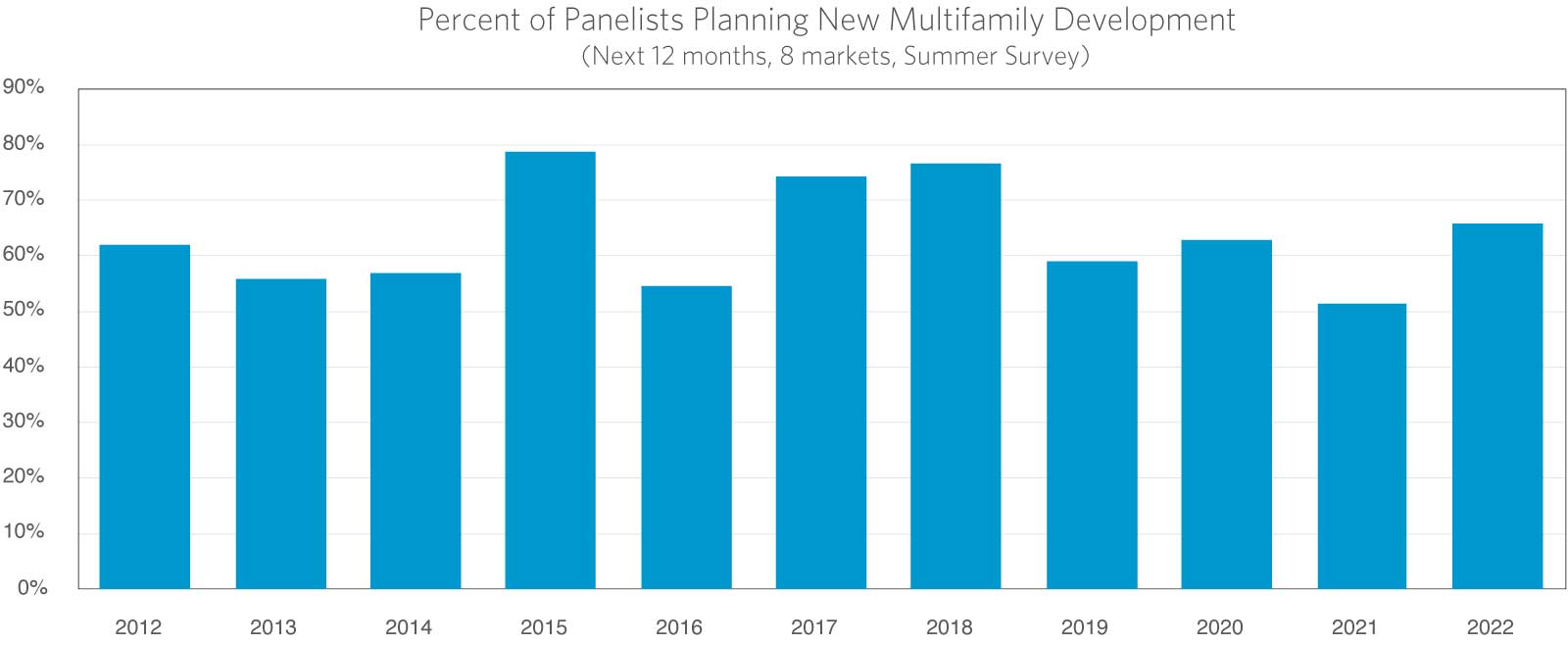

The optimism expressed in the current Survey, though slightly less than a year ago, induced 69% of the Northern California panelists and 86% of the Southern California panelists to plan new multi-family developments in the coming 12 months. Approximately 2/3 of these will start multiple projects. In both Northern and Southern California, demand is expected to outstrip supply through 2025. This demand imbalance will more than compensate for the now higher lending rates and will lead to increased multi-family construction through the coming three years.

“Rising construction costs, labor costs, labor shortages, product shortages, inflation, increasing interest rates. All of those are factors in terms of challenges facing multi-family residential development.”

— Caroline Guibert Chase, Partner, Allen Matkins

Retail Space Markets

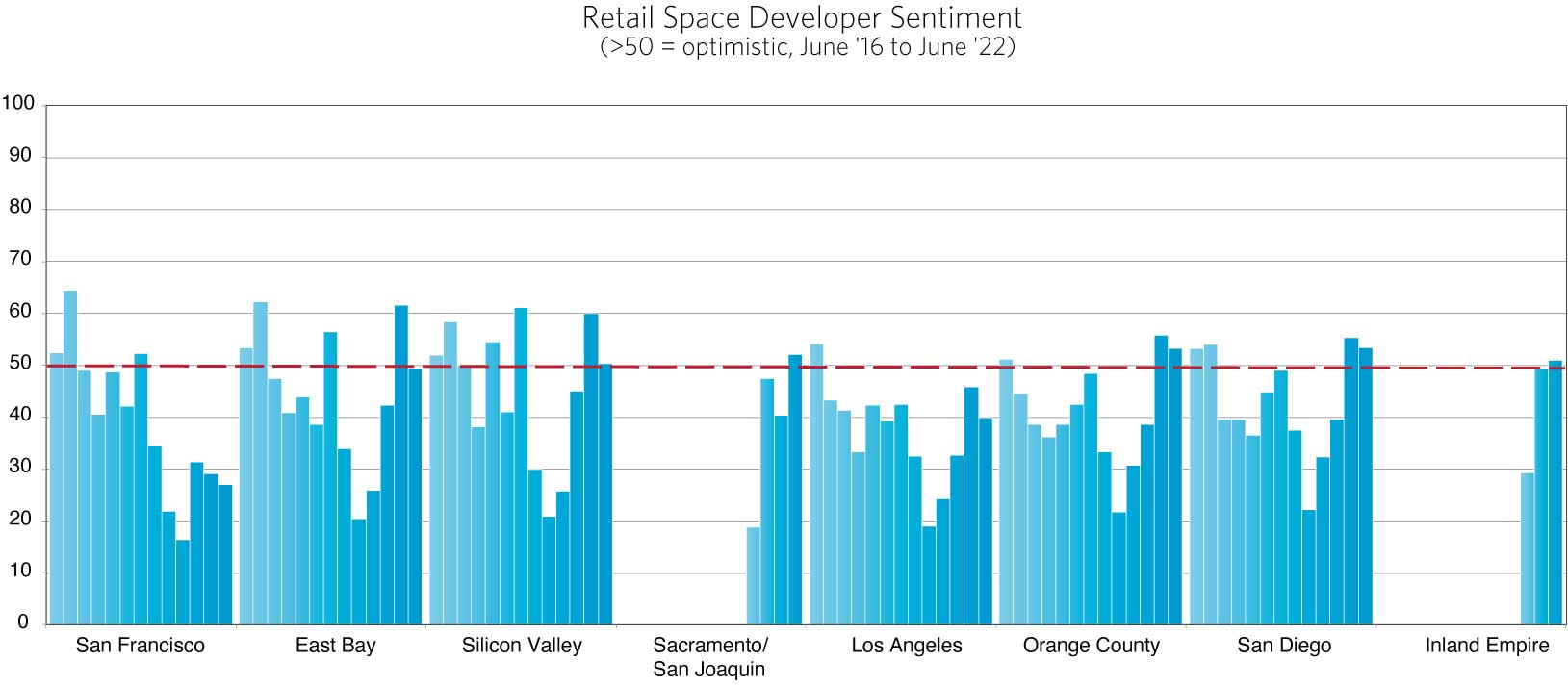

Is retail poised to come back from the bottom of the cycle? The last five surveys indicated yes. For each, sentiment with regard to occupancy and rents over the following three years improved. In the latest Survey, the optimism in six of the markets continued. For San Francisco and Los Angeles, two cities hard hit by work from home and a lack of foreign tourism, pessimism continues (Chart 7). There are three forces at work that help create the optimism in the other six cities. First, a limited return to the office has increased the demand for retail in the core of each city. To be sure, it is not back to where it was pre-pandemic, but the trend is in that direction. Second, the building of new housing throughout the state has created a demand for new retail close to that housing. Third, there is expected to be a demand for the reconfiguration of retail establishments to a more open-air post-COVID concept to attract consumers back to stores.

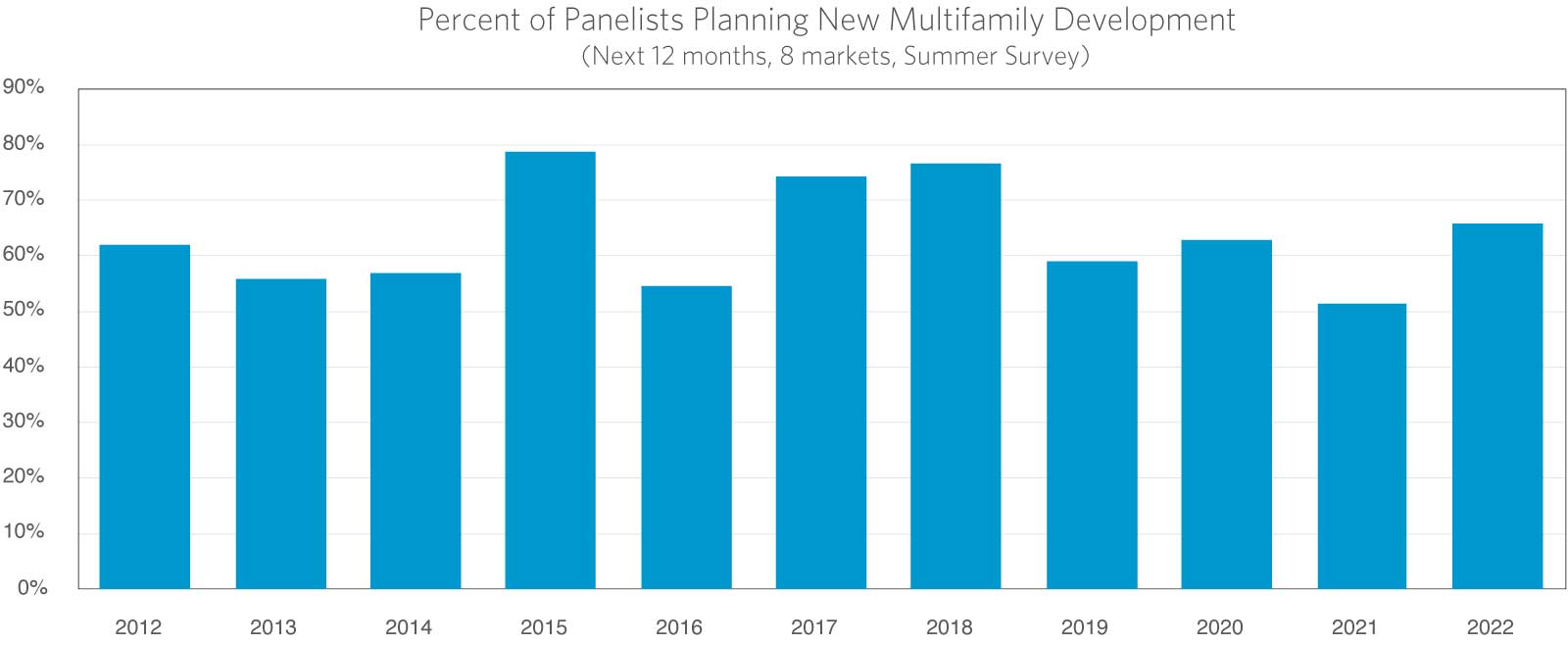

There are now solid targeted opportunities around the state, particularly where new housing developments are springing up. The booming housing market will continue to generate this demand. Although there remains some pessimism expressed in the latest Survey, the overall optimism in it has driven the percentage of the panelists without new development plans over the next 12 months to the lowest level since before 2019 (Chart 8). Nevertheless, the current economic uncertainty should push the actual turn in the market for retail space further into the future. The turnaround in retail development observed in recent surveys appears to be solid and a new retail building cycle should begin before the end of 2025.

“The most successful retail developments over the next few years are going to be more of the class A variety that can attract customers who want to come out and get an experience.”

— Brian Michel, Partner, Allen Matkins

The Survey in Perspective

The Summer 2022 Allen Matkins / UCLA Anderson Forecast California Commercial Real Estate Survey was taken as a new constellation of economic uncertainties was unfolding. While our Survey respondents were understandably more cautious about the coming 12 months than they were in our Winter 2021/2022 Survey, they were also more optimistic on all fronts about the coming three years than expressed in the previous Summer Survey. Industrial markets, which have perennially experienced very low vacancy rates, remain poised for a good run of new building and superior returns. Multi-family housing has rapidly bounced back from a “falling-rent” hiatus and is also in for a run of new project development. Retail markets are showing signs of a new growth cycle. The only negative news in the latest Survey is that a turn in both retail and office markets may take longer than previously predicted. This would be a direct consequence of continued waves of the pandemic and a much more uncertain economic and geopolitical environment than six months ago.

“The pandemic continues to affect each market sector in different ways. While some continue to thrive, such as industrial and multi-family, others, like office and retail, will need more time to determine their trajectories.”

— John Tipton, Partner, Allen Matkins

“Though events over the past six months have altered our forecast, the initial response to the opening up and continued growth in the state’s economy are clearly present in the most recent Survey.”

— Jerry Nickelsburg, Director, UCLA Anderson Forecast